By: B. Cameron Webb, MD, JD

LAST WEEK IN REVIEW: Monday, Oct. 30th – Friday, Nov. 3rd

Following the Trump administration’s new classification of the opioid epidemic as a bona fide public health emergency, the President’s bipartisan opioid commission, led by Gov. Chris Christie, issued its final recommendations to combat the epidemic. Though heavy on recommendations—56 in total—the report put the onus on Congress to determine what would constitute sufficient funding of a federal response. The Centers for Medicare and Medicaid Services (CMS) also made moves on opioids, issuing a new Medicare policy to facilitate the development state demonstration projects to expand access to treatment for opioid use disorder.

With the start of the fifth wave of the Affordable Care Act’s (ACA) Open Enrollment, many experts anticipate sharp declines in ACA enrollment for 2017. While the Department of Health and Human Services (HHS) significantly decreased the marketing budget for Open Enrollment this year, some insurers responded by increasing their marketing efforts by running their own television advertisements and hosting webinars to inform potential enrollees and navigators about their coverage offerings.

Disaster relief efforts continued as Hurricane Maria’s effects still cripple Puerto Rico, with power outages significantly impacting access to healthcare for patients across the island. Additionally, hospitals across the United States continue to face drug shortages related to pharmaceutical products made in Puerto Rico—roughly 10 percent of all drugs consumed by Americans.

The House of Representatives had a busy week, finally passing a reauthorization bill for the Children’s Health Insurance Program—though prospects for the bill in the Senate are grim given the significant opposition from Democrats over its funding. But the House really made a splash on Thursday with the release of a first look at their tax-reform legislation. We break down the tax bill—and its health policy implications—in this week’s Spotlight.

SPOTLIGHT: Health and taxes: Tracking tax reform’s potential impact on health care

“…but in this world nothing can be said to be certain, except death and taxes.”

Though it admittedly comes across as hyperbole, Benjamin Franklin’s 1789 quote takes on a new context when considering Republican tax reform in the wake of unsuccessful efforts to repeal and replace the ACA. Introduced on Thursday by Rep. Kevin Brady (R-Texas), H.R. 1—the Tax Cuts and Jobs Act (TCJA)—is the first step by the majority party in Congress to fulfill President Trump’s promise of delivering the “biggest tax cut…in the history of our country.” But beyond the impact on tax brackets, corporate tax rates, and standard deductions, we thought it would be worthwhile to dive into the health care implications of GOP-led tax reform in the 115th Congress.

Though it admittedly comes across as hyperbole, Benjamin Franklin’s 1789 quote takes on a new context when considering Republican tax reform in the wake of unsuccessful efforts to repeal and replace the ACA. Introduced on Thursday by Rep. Kevin Brady (R-Texas), H.R. 1—the Tax Cuts and Jobs Act (TCJA)—is the first step by the majority party in Congress to fulfill President Trump’s promise of delivering the “biggest tax cut…in the history of our country.” But beyond the impact on tax brackets, corporate tax rates, and standard deductions, we thought it would be worthwhile to dive into the health care implications of GOP-led tax reform in the 115th Congress.

What’s in the proposed tax reform (so far)?

On October 26, House Republicans narrowly passed budget legislation that would cut federal revenue by up to $1.5 trillion over the coming decade. This move was made to help allow the party to pass a new tax plan. With the TCJA being the House’s first proffer on tax reform–and just days after the bill’s introduction—it is fair to say that we are a long way from what will be the final tax bill. Still, the bill provided some critical insights into the direction the GOP ultimately plans to go.

Pushing to the limit of the budget authorization, the TCJA proposed to cut taxes by $1.51 trillion, with $1 trillion from business tax cuts, a net of $300 billion from individual tax cuts, and the ultimate repeal of the estate tax accounting for the final $200 billion. While government often speaks in terms of trillions, the number should hit you as a pretty unimaginable abstraction. Here’s a great article I like to use to help put a trillion dollars in perspective.

In business tax cuts, the main thrust is a reduction of the corporate tax rate from 35 percent down to 20 percent. This move—a key Trump talking point on the campaign trail—would reduce federal revenues by $1.5 trillion. It should be noted that while the United States currently has the highest corporate income tax rates among G20 nations (at 35 percent), it has the fourth highest marginal effective corporate tax rate (at an average of 18.6%), which takes into account the variety of special deductions. These deductions—and the corresponding marginal effective corporate tax rate—vary by industry. The health care sector sees some of the highest marginal effective tax rates, estimated at 54.5% for taxed hospitals and 38 percent for health care support services.

At the individual level, the TCJA offsets roughly $3.0 trillion in tax increases with $3.3 trillion in tax cuts. The bill repeals personal exemptions, eliminates certain exclusions, and reforms itemized deductions (which we’ll come back to) as well as higher education tax benefits. At the same time, it consolidates and reduces individual income tax rates (from seven brackets to four), roughly doubles the standard deduction, repeals the Alternative Minimum Tax (AMT), increases the child tax credit and creates a new filer and dependent credit.

On the whole, the $1.5 trillion in tax cuts amounts to an addition of $1.5 trillion to the federal debt. This impact has been projected to cause the nation’s debt to exceed the size of our economy by 2028, which would be…bad. By Friday, the proposed bill had been amended to cut $81 billion from the tax cuts to individual tax payers (that’s 5.4 percent of the total cost of the tax reform) in an effort to soften the blow.

An overview on the recent history of taxes and health care

Although the Affordable Care Act (ACA) was not passed as a primarily tax reform package, much of the law was, indeed, operationalized through the tax code. In fact, the ACA was full of tax provisions that impacted individuals and employers, as well as major (and minor) players in the health care industry.

To help facilitate insuring more Americans, the ACA offered a series of tax incentives to individuals and businesses. The premium tax credit, options for tax-free health coverage for older children, and even the small business health care tax credit were are implemented through the tax code to help make health care more affordable. Still, to pay for the law—with ten-year cost estimates ranging from $800 billion to $2 trillion—somewhere between one- to two-dozen new taxes on individuals, employers and businesses were included in the ACA.

While the most notorious ACA-related taxes include the individual mandate, the employer mandate, and taxes on high-cost health plans (the “Cadillac” tax), a number of other taxes are important as well. Excise taxes (totaling an estimated $19 billion by 2020) were levied on health insurance providers, pharmaceutical manufacturers and importers, and medical device manufacturers and importers. Additionally, high-income surtaxes beyond payroll taxes and net investment income (NII) taxes for the top five percent of earners (individuals with incomes exceeding $200,000 and couples with incomes exceeding $250,000) were projected to raise an additional $35 billion by 2020. Finally, who could forget the 10 percent excise tax on indoor UV tanning services.

While the most notorious ACA-related taxes include the individual mandate, the employer mandate, and taxes on high-cost health plans (the “Cadillac” tax), a number of other taxes are important as well. Excise taxes (totaling an estimated $19 billion by 2020) were levied on health insurance providers, pharmaceutical manufacturers and importers, and medical device manufacturers and importers. Additionally, high-income surtaxes beyond payroll taxes and net investment income (NII) taxes for the top five percent of earners (individuals with incomes exceeding $200,000 and couples with incomes exceeding $250,000) were projected to raise an additional $35 billion by 2020. Finally, who could forget the 10 percent excise tax on indoor UV tanning services.

Importantly, the ACA also increased the threshold for the medical expense deduction available to taxpayers. Prior to the ACA, taxpayers could deduct medical expenses exceeding 7.5 percent of their income. After the ACA, only medical expenses exceeding 10 percent of income were eligible for deduction. This increased limit was projected to increase federal tax revenue by $3 billion in 2020, bringing the total expected federal deficit reduction to $46 billion if the ACA’s tax provisions were fully implemented.

Potential health care-related effects of the GOP’s current tax reform efforts

The individual mandate. Known as the “individual shared responsibility provision” in the tax code, the ACA required taxpayers to either have minimum essential coverage for each month, qualify for an exemption, or to make a payment when filing their federal income take return. The mandate was expected to reduce the number of uninsured Americans, lower health insurance premiums and also reduce the cost of government subsidies—all while reducing the federal deficit by an estimated $3 billion. After its first few years of implementation, the individual mandate tax penalties amounted to $1.7 billion in tax year 2014 (TY 2014) and $3.1 billion in TY 2015. No data from TY 2016 are yet available from the Internal Revenue Service (IRS).

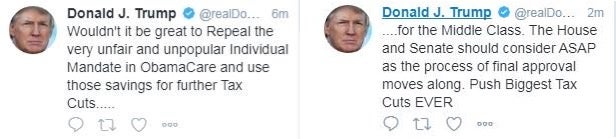

While the TCJA did not initially take aim at the individual mandate, President Trump personally set it on the menu for tax reform with a tweet last week.

Even though, by week’s end, Congressional leaders responded by saying that the individual mandate repeal was under consideration, they also acknowledged that revisiting health care via the tax reform bill could be politically problematic. While the Congressional Budget Office estimates that repealing the individual mandate could save $416 billion over 10 years through decreased federal subsidies for health insurance, it would also result in as many as 15 million more uninsured Americans, as well as premium increases of approximately 20 percent. With multiple failed attempts at repealing and replacing the ACA, some in the Senate are wary of bringing health care into an already difficult tax reform process.

Medical expense deductions. While the ACA raised the threshold for medical expense deductions, the TCJA proposes to eliminate the deduction altogether. Instead of a total impact of $3 billion, eliminating the deduction would increase tax revenue by an estimated $10 billion per year.

As it is currently constructed, the medical expense deduction allows individuals to deduct preventive care, treatment, surgeries and dental and vision care as qualifying medical expenses. Importantly, it can also be used for long-term care expenses for chronically ill patients. An estimated 8.8 million Americans claimed this deduction on their 2015 taxes, with $87 billion in deductions claimed.

While the number of taxpayers claiming the medical expense deduction is relatively small, the repeal of the deduction would have major implications for households with extremely high health-care costs. Nearly half of those who took the medical expense deduction had incomes less than $50,000, and taxpayers with less than $75,000 in income deducted an average of $8,990—a more significant deduction than the $6,384 for the home mortgage interest (HMI) deduction or the $2,768 for charitable contributions claimed by taxpayers with similar incomes. The AARP strongly opposed the provision, noting its effect as a “new health tax” on middle income seniors with high medical costs.

Budgetary offsets (Medicaid and Medicare). In order to pay for $1.5 trillion in tax cuts over the next decade without increasing the federal deficit, federal spending would have to decrease, as well. In its budget blueprint released last month (which authorized the $1.5 trillion in tax cuts), Senate Republicans also planned to reduce spending by $5 trillion over the next 10 years in order to reduce the deficit. Democrats on the Senate Budget Committee, however, published their breakdown of where the 2018 budget planned to reduce that spending, with significant implications for Medicaid and Medicare.

Specifically, Senate Democrats contended that the Republican budget would reduce federal contributions to Medicaid by more than $1 trillion over the next year. Citing the CBO’s June 2017 baseline, and assuming that Medicaid would receive its proportional share of budget function 550 mandatory cuts, they estimated that Medicaid would see a 5.0 percent cut in 2018, gradually increasing to a 29.6 percent cut in funding by 2027 (relative to 2017 funding levels).

Additionally, the budget reportedly includes $473 billion in budget cuts over ten years from Medicare. More immediately, the 2010 pay-as-you-go rule (PAYGO) necessitates certain mandatory cuts, which would amount to $28 billion cut from Medicare between January and September 2018.

The road ahead

This week, the House Ways and Means committee begins its markup of the bill, offering the first glimpse at changes to increase its likelihood of passing. The Speaker of the House, Rep. Paul Ryan (R-Wisconsin) has expressed his goal of having the tax reform passed in the House by Thanksgiving. The Senate, led by its Senate Finance Committee, is also launching a parallel process in the next few weeks. Both chambers have expressed that they hope to resolve any differences and pass a final bill before 2017 comes to a close.

President Trump and several key Republican legislators continue to advocate for action on the individual mandate, with others in the GOP still hesitant about the potential political impact of reinvigorating the health care debate in the new efforts for tax reform. With Republicans in the 115th Congress committed to success in this latest effort at executing their agenda, there will likely be significant debate to come regarding the political merits of intended and unintended health care effects flowing from current tax reform efforts.

Student Contributors on this Article:

Marissa Alvarez, Chad Fletcher, Shaina Haque